Compare the rules and requirements of 403(b) and 401(k) plans Tap to read full story.

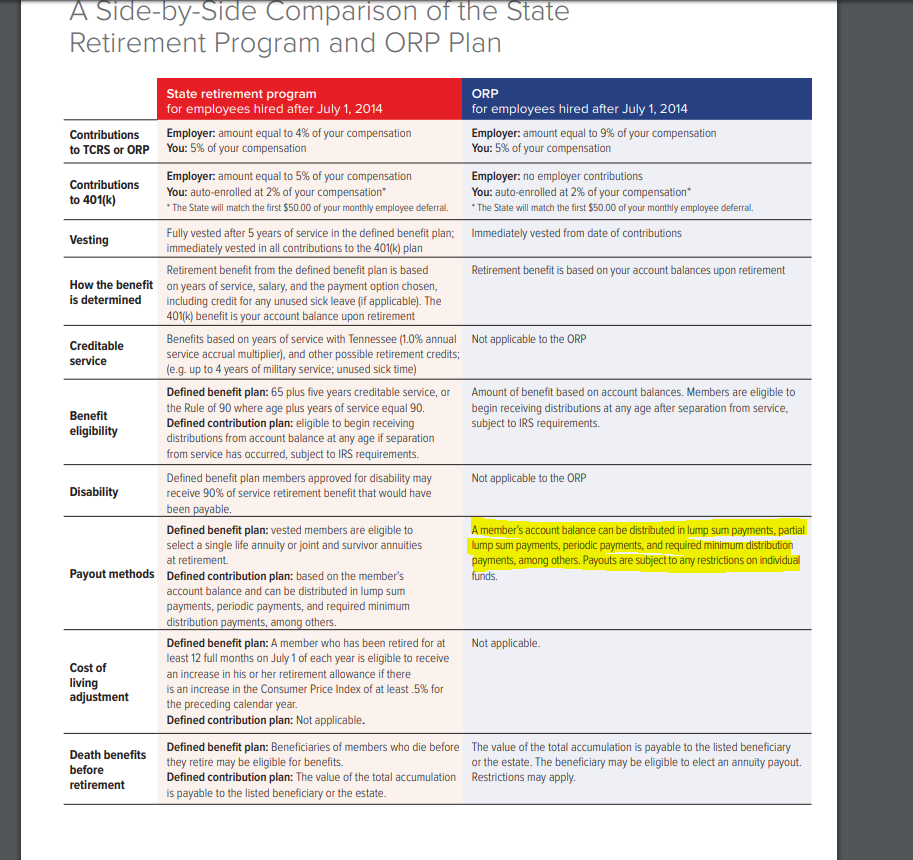

A 457 also works much like a 401(k), but there are differences in contribution limits and the treatment of early withdrawals.. If your employer also offers a 401(k) or 403(b) plan, you can contribute to both the 457 and the other plan for a whopping $35,000 in total or, if you’re 50 or older, $46,000 in total.. Learning Objectives: 1 Discuss plan design options for tax-exempt organizations.. All offer similar tax benefits; the major difference is in who can use them Here’s how they break down:401(k)s are the version that corporations offer to their employees.. (Roth 401(k)s are a subgroup that has different tax treatment )403(b)s are for employees of public education entities and most other nonprofit organizations.

Silicon Decal Keyboard Cover Keypad Skin Protector For Mac

Thrift Savings Plans (TSPs) are for federal employees, including members of the uniformed services.. Attend this webcast to understand the differences between 403(b) and 401(k) plans, and why it is important to choose the right plan type.. 401k: What's The Difference? The 401k plan is a retirement plan offered to employees of for-profit organizations. Free Whiteboard App For Mac

cea114251b

0